Online Debt Consolidation Loans

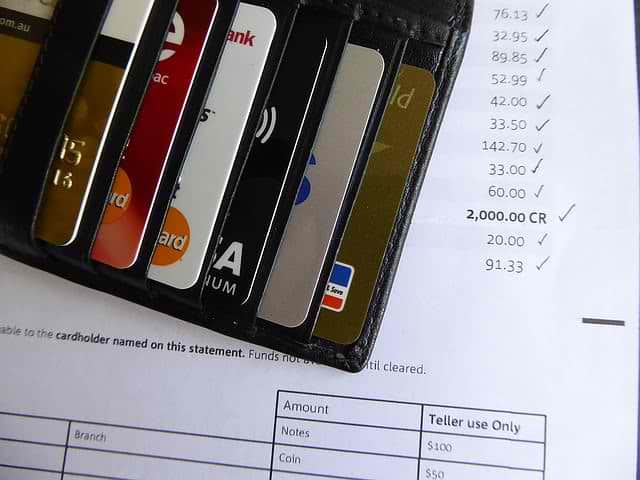

Almost every consumer is reeling under financial debts nowadays thanks to unrestrained spending behaviors. Debt is definitely a trouble which intensifies if prompt steps of managing it are not in place. There comes a stage when you need to repay debts immediately or you remain in deep trouble. On the internet financial obligation consolidation financings are completely made for saving you from financial debts. Maintaining the relevance and necessity for coming out of financial debts in mind, on-line financial debt loan consolidation car loans are used in an inconvenience totally free fashion.

On-line financial debt loan consolidation financings are given by online lending institutions. On the internet lending institutions remain in setting of refining the lending quicker which allows them in authorizing the lending amount within days. Obtaining on the internet financial debt combination fundings is very straightforward. A debt ridden person fills out details of the loan in on the internet application layout that is provided with each online loan provider’s internet site. Complete your car loan requirement, settlement period and personal information and with the click of the mouse the information is with the loan provider. He will quickly notify if you are right candidate for the finance or otherwise. If the lending institution is completely satisfied, the funding is rapid authorized.

Online financial obligation combination fundings are meant for combining financial obligations under a brand-new lending institution. You do not eliminate the debts. However instead remove the higher rate of interest debts and also change them with a brand-new on-line financial obligation combination financing of lower rate of interest. The advantage in doing so lies in paying month-to-month installations to just one lender instead of to numerous as well as therefore you save lots of cash besides having a lighter financial obligation concern. So, online debt loan consolidation car loans ought to essentially be taken at reduced rates of interest.

The very best method for guaranteeing reduced rates of interest is opting for protected online debt loan consolidation car loans. The secured fundings are offered on taking borrower’s property like residence as security. How lower a rate of interest under safeguarded financial obligation combination financings can be? Well it depends upon lot of factors. If your obtained quantity is less than the equity as well as likewise if you have contrasted different loan providers extensively, you can accomplish the rate of interest needed for taking protected online financial debt loan consolidation finances beneficially.

Guaranteed on the internet financial debt loan consolidation lendings can be settled comfortably in 5 to 30 years. Larger payment period indicates you can minimize your monetary outgo towards month-to-month installments.

On the other hand you can pay off all smaller financial obligations through unprotected on-line financial obligation loan consolidation finances without putting your property in jeopardy. The unprotected financings are preferable to renters that generally have smaller sized financial debts. Yet as risks are numerous for the lenders, they tend to charge greater rate of interest on unsafe on-line debt combination loans.

The payment duration also is much shorter again to reduce dangers. The lending is only given on payment ability and also excellent credit score of the customer. Negative credit rating does not matter much in case of safeguarded online debt loan consolidation car loans as lender can recuperate the finance on marketing customer’s residential or commercial property while consumers need to encourage the lender in case of taking the unsafe loan. Check out the article source in this link to learn more tips on how to pay off debt.

Surely on-line financial obligation loan consolidation loans can rescue a financial debt ridden person from foreshadowing crisis. Take different facets of the loan in factor to consider and pay off loan installments in time for running away any additional financial debts.